Debt Recycling Explained: How to Turn Your Debts into Investments

Debt recycling is a powerful strategy that allows individuals to leverage their existing debts and transform them into investment opportunities. By understanding the concept of debt recycling and implementing it effectively, you can potentially accelerate your wealth creation and achieve financial freedom. In this article, we will explore the meaning of debt recycling, its mechanics, benefits, potential risks, steps to get started, and how to manage your debt recycling strategy.

Understanding the Concept of Debt Recycling

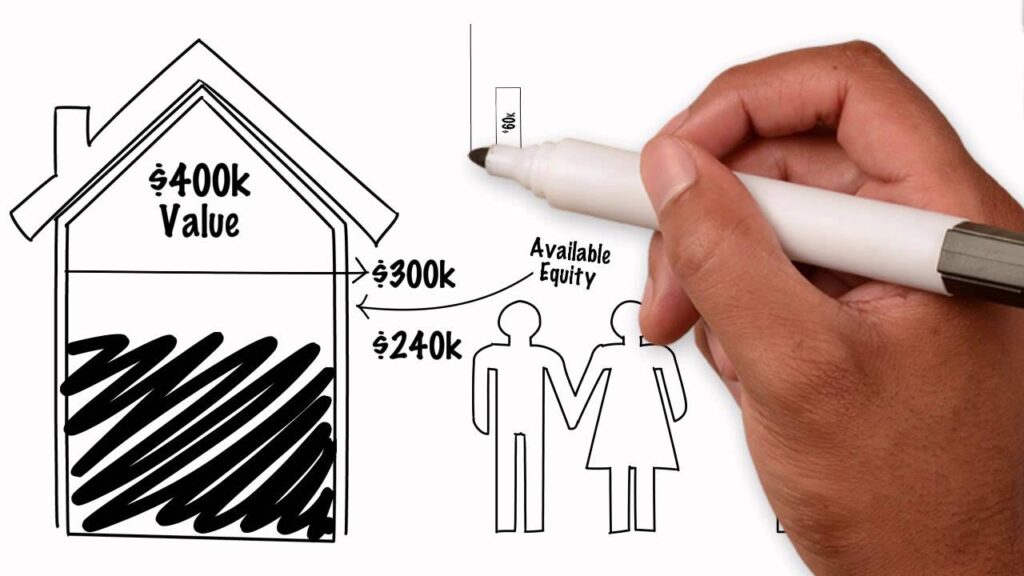

Debt recycling is a financial strategy that has gained popularity among savvy investors looking to maximize their wealth-building potential. By leveraging existing debts, such as a mortgage or personal loans, individuals can strategically invest for debt management solutions recommended by financial advisor Sydney in income-generating assets to create a cycle of wealth accumulation. The fundamental principle behind debt recycling is to use borrowed funds to generate additional income that not only covers the interest costs of the debts but also has the potential to yield substantial returns over time.

Defining Debt Recycling

At its core, debt recycling is a sophisticated wealth creation technique that requires careful planning and execution. By harnessing the power of compound interest and strategic investment decisions, individuals can effectively turn their liabilities into assets. This financial strategy is not without risks, as it involves utilizing borrowed funds to invest in the volatile market, but when implemented thoughtfully, it can yield significant long-term benefits.

The Mechanics of Debt Recycling

Delving into the mechanics of debt recycling unveils a strategic approach to financial management. The key concept revolves around converting non-deductible debts, such as personal loans or credit card debts, into deductible debts, like an investment property loan. By refinancing high-interest non-deductible debts into lower-interest deductible debts, individuals can not only reduce their overall interest expenses but also unlock potential tax benefits.

Moreover, the beauty of debt recycling lies in its ability to reallocate saved funds from tax deductions towards new investments. This shift in capital allocation allows individuals to diversify their portfolio, explore new income streams, and ultimately strive towards financial independence and prosperity. Click here to also get about simplifying your retirement planning with SMSF setup.

The Benefits of Debt Recycling

Financial Advantages

The primary financial advantage of debt recycling is the potential to accelerate wealth creation. By using your debts to invest in income-generating assets, you can create multiple sources of cash flow that go beyond your regular income. This additional income can be reinvested, further compounding your investment returns and increasing your net worth over time.

Moreover, debt recycling can also provide tax benefits. In some countries, the interest on investment loans used for income-generating purposes may be tax-deductible, reducing your overall tax liability. This tax efficiency can enhance your investment returns and contribute to your financial growth.

Long-term Impact on Wealth

Debt recycling, when implemented correctly, can have a significant long-term impact on your wealth. By actively managing your investment portfolio and consistently applying the strategy, you can achieve financial independence and enjoy a comfortable retirement.

Furthermore, the concept of debt recycling aligns with the principle of leveraging. By strategically using your debts to invest in growth assets, such as property or stocks, you can potentially benefit from capital appreciation and maximize your overall wealth accumulation. This approach allows you to amplify your investment gains without requiring a significant initial capital outlay, leading to a more efficient wealth-building process.

The Risks Involved in Debt Recycling

Potential Financial Pitfalls

Debt recycling, like any financial strategy, carries certain risks. One of the main risks is the possibility of the investments not generating the expected returns. If the income generated from your investments is insufficient to cover the interest costs of the debts, it can lead to a negative cash flow situation and financial strain.

It is crucial to carefully assess the investment opportunities and ensure they have a high likelihood of providing consistent returns before committing to debt recycling.

Moreover, another significant risk associated with debt recycling is the potential impact of economic downturns or market fluctuations. In times of financial instability, the value of investments may decline, affecting your ability to service the debt effectively. It is essential to have contingency plans in place to mitigate such risks and safeguard your financial well-being.

Assessing Your Risk Tolerance

Another risk factor to consider is your risk tolerance. Debt recycling involves taking on additional debts, which can be a stressful prospect for individuals with a low risk tolerance. It is important to evaluate your comfort level with debt and determine whether you have the financial stability and discipline to withstand potential market volatility.

Seeking professional advice from a financial planner or advisor can help you assess your risk tolerance and develop a suitable debt recycling strategy that aligns with your goals and circumstances.

Furthermore, it is essential to consider the impact of interest rate fluctuations on your debt recycling strategy. Changes in interest rates can affect the cost of borrowing and the overall profitability of your investments. By staying informed about economic trends and interest rate forecasts, you can make informed decisions to protect your financial interests and optimize the benefits of debt recycling.

Steps to Start Debt Recycling

Evaluating Your Current Debts

The first step in starting debt recycling is evaluating your current debts. Gather all the necessary information about your outstanding loans, including interest rates, repayment terms, and any associated fees. This assessment will help you determine which debts are suitable for recycling and refinancing.

Consider consulting with a mortgage broker or financial advisor to analyze your current debt structure and identify opportunities for optimization.

Furthermore, it’s essential to understand the impact of your current debts on your overall financial health. Assessing your debt-to-income ratio and understanding how your debts contribute to your credit score can provide valuable insights into your financial situation. By gaining a comprehensive understanding of your debts, you can make informed decisions about which ones to prioritize for recycling.

Identifying Suitable Investments

Once you have evaluated your debts, the next step is to identify suitable investments. Look for income-generating assets that have the potential to generate positive cash flow and yield returns that surpass the costs of the associated debt.

Consider options such as investment properties, shares, or managed funds. Conduct thorough research, analyze the historical performance of the investments, and carefully consider their future growth prospects. Diversification across different asset classes or industries can also help mitigate risk.

Moreover, when selecting investments for debt recycling, it’s crucial to align them with your financial goals and risk tolerance. Consider creating a diversified investment portfolio that balances risk and return based on your investment horizon and objectives. By strategically matching your investments with your debt recycling strategy, you can optimize your financial outcomes and work towards achieving long-term wealth accumulation.

Managing Your Debt Recycling Strategy

Regular Monitoring and Adjustments

Managing your debt recycling strategy requires regular monitoring and adjustments. Keep track of your investment performance, debt levels, and cash flow. Make necessary adjustments to your investment portfolio and debt structure as market conditions change.

It’s important to understand that debt recycling is not a set-it-and-forget-it strategy. Just like tending to a garden, it requires ongoing care and attention. By regularly reviewing your debt recycling strategy, you can ensure that it continues to align with your financial goals and adapt to any changes in your circumstances.

One aspect to monitor is your investment performance. Keep a close eye on how your income-generating assets are performing. Are they meeting your expectations? Are there any opportunities to optimize your portfolio? By staying vigilant, you can make informed decisions about when to buy, sell, or hold certain investments.

Another area to focus on is your debt levels. As you continue to recycle your debts, it’s crucial to strike a balance between leveraging your assets and managing your liabilities. Regularly assess your debt-to-equity ratio and ensure that it remains within a comfortable range. This will help you maintain financial stability and mitigate any potential risks.

Seeking Professional Advice

It is highly recommended to seek professional advice when implementing a debt recycling strategy. A qualified financial advisor or mortgage broker can provide specialized guidance based on your individual circumstances. They will help you navigate potential risks, develop a tailored plan, and provide ongoing support to ensure your debt recycling strategy remains on track.

When it comes to managing your finances, having a trusted expert by your side can make a world of difference. A professional advisor can help you identify opportunities that you may have overlooked and guide you through the complexities of the financial landscape.

Moreover, they can assist you in staying up-to-date with tax regulations. Tax laws can change frequently, and it’s important to understand how they may impact your debt recycling strategy. By working with a knowledgeable advisor, you can ensure that you are maximizing deductions and optimizing your financial outcomes within the bounds of the law.

Debt recycling can be a powerful wealth creation strategy when implemented with careful consideration and expert guidance. By leveraging your existing debts to invest in income-generating assets, you can potentially accelerate your financial goals and secure a brighter future.

Remember to conduct thorough research, assess your risk tolerance, and seek professional advice to maximize the potential benefits of debt recycling. With prudent management and disciplined execution, you can transform your debts into valuable investments and embark on a path towards financial independence and prosperity.